-

Products

-

Transportation & Mobility Solutions

Transportation & Mobility Solutions

At Hitachi, we engineer industry-leading transportation and mobility solutions by leveraging decades of knowledge and using high-quality automotive material and components.

-

Energy Solutions

Energy Solutions

We believe the only solution for fulfilling the growing power requirements of industries and society is through a comprehensive portfolio of sustainable energy solutions and delivering innovative high-efficiency energy systems.

-

IT Infrastructure Services

IT Infrastructure Services

Hitachi’s state-of-the-art IT products and services are known to streamline business processes which result in better productivity and a higher return on investment (ROI).

-

Social Infrastructure: Industrial Products

Social Infrastructure: Industrial Products

Within the industrial sector, Hitachi is consistently delivering superior components and services, including industrial and automation solutions, useful in manufacturing facilities.

-

Healthcare & Life Sciences

Healthcare & Life Sciences

At Hitachi, we believe that healthcare innovation is crucial to a society’s advancement. A strong healthcare sector is often considered an inseparable element of a developed society.

-

Scientific Research & Laboratory Equipments

Scientific Research & Laboratory Equipments

Hitachi focuses on extensive research and development, transformative technology, and systems innovation to unfold new possibilities and create new value through scientific endeavors that strengthen the connection between science and social progress.

-

Smart Audio Visual Products

Smart Audio Visual Products

Since 1956, Hitachi audio visual products have provided state of the art solutions to consumers all over the world. It has been our pleasure to design competitive products at the lowest possible prices while maintaining our industry-leading quality standards for your comfort and enjoyment.

-

View All Products

Hitachi Products & Solutions

Hitachi, a technology leader in the U.S., offers a diverse set of products and solutions, and breakthrough technologies for smart manufacturing, green energy and mobility solutions that empower governments, businesses, and communities.

-

Transportation & Mobility Solutions

- Social Innovation Solutions

-

About Us

-

Hitachi in the U.S.A.

Hitachi in the U.S.A.

Discover information about the Hitachi group network across the Americas, upcoming events and sustainability endeavours, CSR policies, and corporate government relations.

-

About Hitachi Group

About Hitachi Group

Explore our leadership team, investor relations, environmental vision, and sustainability goals. Learn how Hitachi is leveraging its research & development capabilities for social innovation across industry verticals.

-

Hitachi in the U.S.A.

- News Releases

- Case Studies

- Careers

- R&D

Hitachi Agrees to Acquire JR Automation, a Robotic System Integrator in the US

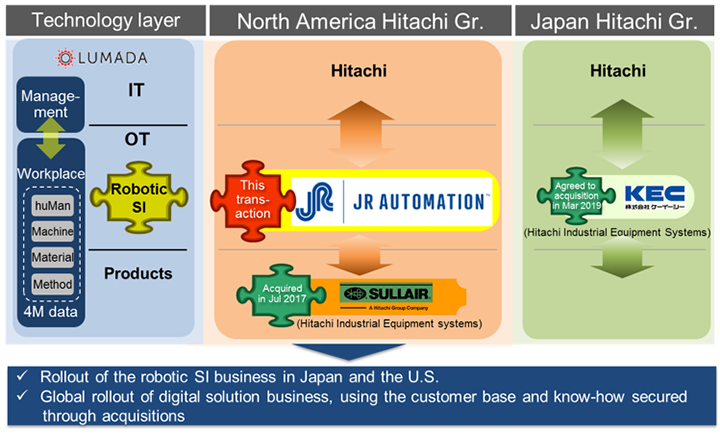

Hitachi will be entering the high-growth robotic SI(1) business in North America and accelerate the global development of its digital solution business, which connects the workplace and management, by acquiring a customer base, technology, and know-how in the Operational Technology (OT) domain

Rollout of Hitachi’s robotic SI business and 4M(2) data utilization image, through acquisitions

Tokyo, April 24, 2019 --- Hitachi, Ltd. (TSE:6501, “Hitachi”) today announced that on April 23, 2019 it entered into a definitive contract for the acquisition of the robotic SI business mainly operated by an American headquartered company, JR Automation Technologies, LLC (CEO: Bryan Jones, “JR Automation”), from funds managed by Crestview Partners (“Crestview”). Subject to the terms and conditions of the contract, Hitachi will acquire JR Automation, which builds production lines and logistics systems using industrial robots. As a result of this acquisition, Hitachi will enter the robotic SI business in North America, which is a region that is expected to see a high rate of growth. The acquisition is expected to be executed by the end of 2019, subject to the satisfaction of certain regulatory and other customary closing conditions.

In the Industry Sector(3), Hitachi will continue to accelerate the global rollout of the robotic SI business, together with the acquisition of KEC Corporation (KEC), a Japanese robotic system integrator, for which an acquisition contract was completed by Hitachi Industrial Equipment Systems Co., Ltd. (HIES) in March 2019(4).

In 2017, Hitachi acquired Sullair, an American manufacturer and seller of air compressors, marking a full-scale entry into the North American industrial product business(5). With the acquisition of JR Automation, Hitachi will acquire JR Automation’s customer base in the OT domain, along with advanced robotic SI technologies, know-how, and resources. Additionally, the acquisition of JR Automation will allow Hitachi to further expand its Lumada Solution business, globally. Lumada is Hitachi’s advanced digital solutions, services, and technologies business, which helps customers and management turn their workplace data into insights to drive digital innovation.

In recent years, in the manufacturing and logistics fields, there has been a growing demand for automation because of decreased working age populations, intensifying global competition, and further quality improvement requirements to prevent significant product recalls. As a result, the global robot-based automation market continues to expand, with a high average growth rate exceeding 10% per year.

Since its establishment in 1980, JR Automation has been involved in the robotic SI business, building production lines that incorporate industrial robots, predominantly in North America but increasingly around the world. It is capable of designing, building, and adjusting not only specific lines but entire production lines, and demonstrates unique strengths and expertise in robot-based assembly and welding processes. As such, JR Automation has a robust customer base across a wide range of industries, including the automotive, aerospace, e-commerce, and medical device industries.

In Hitachi’s Industry Sector, as part of its efforts to become a “Best Solution Partner” for industrial customers, Hitachi is expanding its Lumada Solution business by leveraging its combined strengths in products, OT, and IT. To further strengthen the business in the OT domain, HIES executed a contract in March 2019 for the acquisition of KEC, a Japanese robotic system integrator.

The acquisition of JR Automation will allow Hitachi to acquire additional advanced technologies, know-how, and resources in the robotic SI business that JR Automation has cultivated over many years, in addition to a customer base across a broad range of industries. Meanwhile, JR Automation will use Hitachi’s advanced R&D technology and resources, aiming to add value to its robotic SI business by utilizing data.

In the Industry Sector, Hitachi will roll out a robotic SI business by leveraging the resources of JR Automation, with its customer base in the U.S. and other regions globally, in addition to HIEC and KEC, with their customer mainly bases in Japan and other parts of Asia. As a result of these initiatives, Hitachi will expand Lumada Solutions globally. Specifically, 4M data from the workplace, obtained by the robotic SI business, will allow for Lumada Solutions to expand across multiple fields, including visualization, manufacturing optimization, logistics, and maintenance. In this way, Hitachi seeks to contribute to improving the value of our customers' businesses by seamlessly visualizing and analyzing businesses as a whole, from the workplace all the way through to management.

Comment from Masakazu Aoki, Executive Vice President, Hitachi, Ltd.

“I am extremely pleased that we have reached an agreement on the acquisition of JR Automation. Securing JR Automation’s robotic SI business in North America is an important milestone for us. By providing customers with new value that combines Hitachi’s products, OT, IT, and advanced digital technologies, we will accelerate the global rollout of our Social Innovation Business.”

Comment from Mr. Bryan Jones, CEO, JR Automation

“We are very excited to partner with Hitachi to take this next step in the company’s evolution. With our combined capabilities, Hitachi and JR Automation will be a uniquely qualified global leader in next generation smart manufacturing, and this partnership will enable us to continue to drive tangible value creation for our customers through innovative custom solutions. On behalf of everyone at JR Automation, I would like to thank the team at Crestview Partners and outgoing Chairman Mike DuBose, for their outstanding partnership and leadership during this period of dramatic global growth for JR Automation.”

The acquisition price for JR Automation is US$ 1,425 million (approx. 158.2 billion yen) on a cash-free debt-free basis. The total purchase price is subject to a possible post-closing adjustment; for example, in the event of certain fluctuations in JR Automation’s net working capital or net liabilities.

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. is acting as exclusive financial advisor to Hitachi. Goldman Sachs & Co. LLC and BofA Merrill Lynch acted as financial advisors to JR Automation and the selling shareholders.

- (1)

- SI: Systems Integration

- (2)

- 4M: huMan, Machine, Material, and Method.

- (3)

- “Industry Sector” is one of the five key sectors identified in Hitachi’s “2021 Mid-term Management Plan.” For further details, please refer to the Hitachi, Ltd. news release dated February 1, 2019 titled “Hitachi to Strengthen Business Structures for a Transformation into a Global Leader, as Laid Out in the 2021 Mid-term Management Plan” http://www.hitachi.com/New/cnews/month/2019/02/190201b.html

- (4)

- Hitachi Industrial Equipment Systems news release dated March 22, 2019 titled “Hitachi Industrial Equipment Systems Entered into Agreement to Acquire KEC, Robotic System Integrator” http://www.hitachi.com/New/cnews/month/2019/03/190322.html

- (5)

- Hitachi, Ltd. news release dated April 25, 2017 titled “Hitachi Enters into Agreement to Acquire Air Compressor Manufacturer, Making a Full-scale Entry into the North America Industrial / Distribution Business” http://www.hitachi.com/New/cnews/month/2017/04/170425.html

Outline of JR Automation(6)

| Name | JR Automation Technologies, LLC |

|---|---|

| Head Office | Holland, MI (USA) |

| Representative | CEO: Bryan Jones |

| Outline of Business | Robotic System Integration |

| Founded | 1980 |

| Capital (end of December 2018) |

Approx. US$ 224 million (approx. 24.8 billion yen) |

| Main Shareholders and Shareholding Ratios | Funds managed by Crestview Partners (93%) (Indirect) Others (7%) |

| Revenues (Consolidated Basis) (2018) |

Approx. US$ 603 million (approx. 67 billion yen) |

| Total no. of Employees: (end of March 2019) |

Approx. 2,000 |

- (6)

- Converted as US$ 1 = 111 yen.

Effects on future business performance

Shareholders will be notified immediately in the event that this transfer of shares has a significant impact on Hitachi’s consolidated business results for the year ending on March 31, 2020.

About Hitachi, Ltd.

Hitachi, Ltd. (TSE: 6501), headquartered in Tokyo, Japan, delivers innovations that answer society’s challenges, combining its operational technology, information technology, and products/systems. The company’s consolidated revenues for fiscal 2017 (ended March 31, 2018) totaled 9,368.6 billion yen ($88.4 billion). The Hitachi Group is an innovation partner for the IoT era, and it has approximately 307,000 employees worldwide. Through collaborative creation with customers, Hitachi is deploying Social Innovation Business using digital technologies in a broad range of sectors, including Power/Energy, Industry/Distribution/Water, Urban Development, and Finance/Social Infrastructure/Healthcare. For more information on Hitachi, please visit the company's website at http://www.hitachi.com.

| Presentation Material |

|---|

Contacts

Ai Marutani

Hitachi, Ltd.

+81-3-5208-9324

ai.marutani.et@hitachi.com

Kensuke Katagiri

Hitachi, Ltd.

+81-3-5208-9324

kensuke.katagiri.dc@hitachi.com